China’s demand to include its state-owned shipping giant, Cosco, in a major Panama ports deal has thrown the entire transaction into uncertainty, challenging US interests and geopolitical stability.

A Geopolitical Standoff

In a twist that should shock absolutely no one paying attention to China’s aggressive strategies, Beijing has drawn a line in the sand over an international business deal that impacts the Panama Canal. CK Hutchison, a Hong Kong company, proposed selling its global port assets to BlackRock and MSC for a whopping $22.8 billion. This sale includes two vital ports at the Panama Canal, a chokepoint for global trade. However, China, wielding its usual regulatory power, demands that its state-owned shipping titan, Cosco, be made an equal partner in the deal—or else.

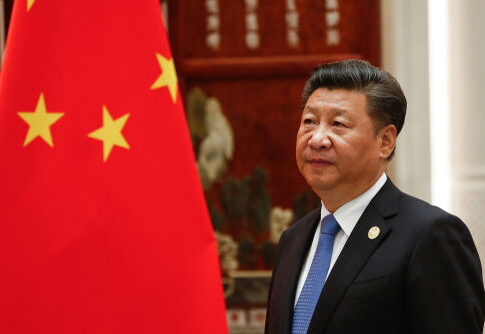

President Trump, recognizing a strategic opportunity, has hailed the deal as a national security victory for America. The prospect of shifting control of these ports away from Chinese influence has been framed as a win for US interests. Yet, as China flexes its muscles, the entire transaction now hangs in the balance, reflecting the ongoing economic chess game between the world’s two superpowers.

Strategic Infrastructure in the Crosshairs

For those who understand the importance of the Panama Canal, this is more than just a business deal; it’s a strategic maneuver. The ports are essential nodes in global supply chains, facilitating trade between the East and West. China’s insistence on Cosco’s inclusion reveals its relentless ambition to maintain a grip on critical infrastructure worldwide. This move comes amid heightened US-China trade tensions and serves as yet another reminder of the lengths to which China will go to assert its dominance.

Historically, China has not shied away from using its state-owned enterprises to influence international deals. Back in 2014, it blocked a major shipping alliance involving MSC to shape the industry to its liking. This latest demand for Cosco’s involvement is consistent with that approach. The threat to block the current transaction unless its demands are met is nothing short of a geopolitical power play.

Implications for Global Trade and Politics

The implications of this standoff are far-reaching. In the short term, BlackRock and MSC face uncertainty that could derail the deal or force a significant restructuring. BlackRock’s stock has already taken a hit as investors react to the potential fallout. More broadly, the dispute underscores the fragility of global supply chains and the critical importance of infrastructure security. If China succeeds in inserting Cosco into the deal, it will retain or even increase its influence over these strategic ports, raising alarms about the balance of power in maritime logistics.

The outcome of this saga could set a precedent for future infrastructure deals involving Chinese interests. Western investors may become increasingly cautious, wary of China’s regulatory reach and political maneuvering. As the world watches, the July 27 deadline for exclusive talks looms large, with the potential to either resolve the standoff or escalate tensions further.